On April 29, the Bureau of Economic Analysis released an advance estimate of U.S. economic growth in the first quarter of 2020. The estimate showed a decline of 4.8 percent for the quarter. Remember that this analysis is based on incomplete data and will be revised over time as more information is confirmed. And remember that it takes two or more negative quarters to officially be considered a recession. So, what does this mean? I am reminded of this quote from Winston Churchill:

“Now this is not the end. It is not even the beginning of the end. But it is, perhaps, the end of the beginning.”

Sir Winston Churchill, Speech in November 1942

Perhaps we are beginning to get a handle on the COVID-19 pandemic. Maybe we will see our businesses return soon. And, yes, we may be entering a recession. And the great thing about entering a recession is that you must enter a recession to come out of a recession. So, we are on the path to recovery.

Perspective On Recessions

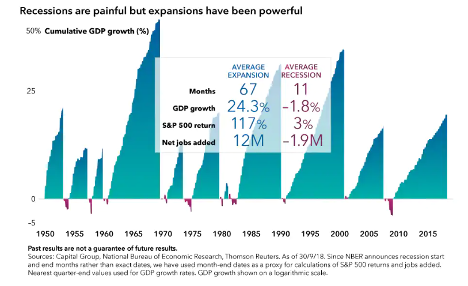

Generally, recessions do not last that long. We have had 10 market cycles since 1950 and the recessions have ranged from eight to 18 months, with the average lasting about 11 months. For those directly affected by job loss or business closures, that can feel like an eternity. But investors seeking to grow savings for goals three or four years, or more, into the future would be wise to focus on long-term results of quality investments.

Recessions are relatively small blips in economic history. Over the last 65 years, the U.S. has been in an official recession less than 15 percent of all months. And, the net economic impact of most recessions also is relatively small. The average expansion increased economic output by 24 percent, whereas the average recession only reduced GDP less than 2 percent. Surprisingly, equity returns average 3 percent growth during the life of the recession. This is thanks to a pattern of strong stock rallies that come before the economy has completely recovered during the late stages of a recession.

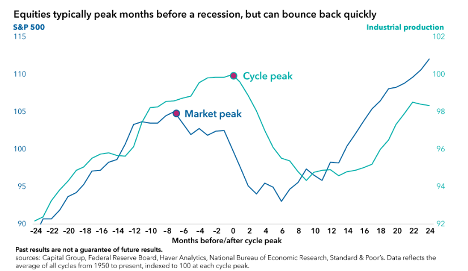

This is a reminder that the markets tend to anticipate the economy. Markets historically top out before the economy tops out and then rebound before the economy does.

This is another reminder of how hard it is to time the market. Perceiving the top and the bottom of the market cycle is extremely hard. Academic research shows that most so-called experts fail to get it right.

How To Respond To a Recession

So, it looks like we are really in a recession. What should you do for your investments?

Well, it depends. One of my favorite experts recently said this about the COVID-19 market pullback as of early April: “It’s too late to get out of the market. And it’s too early to get back into the market.”

If you are looking to adjust your investment holdings, you need to keep a focus on long-term goals and not be distracted by daily moves in investment prices. It’s very likely that investment prices will fall sharply as economic contraction begins to bite later this year. It will be easy to make a mistake.

Now is a great time to review your spending needs for the next year. Be sure you have plenty of cash at hand to cover your needs. For the money you plan to grow for your use in two or three or more years into the future, keep it prudently invested for growth.

To get a handle on what specifically you should do now to better achieve your financial goals, I always think a great place to start is by talking with a couple CERTIFIED FINANCIAL PLANNER™ professionals.

To find a CFP® professional near you, start your search here.

As you visit with financial planners, I suggest a couple things to check:

- Is the advisor always the client’s advocate – a fiduciary advisor?

- Is the advisor only paid by clients, not any financial product manufacturer or distribution network? That would be a fee-only advisor.

These two points help assure that you are working with a professional who is committed to your best interest at all times. It seems sort of obvious to me that a professional would work in this way, but it’s not automatic.

A fiduciary, fee-only, CFP® professional can help you make great retirement income choices and develop a comprehensive financial plan that is driven by your goals and priorities and addresses all aspects of your financial life. With a big-picture approach, you will be better prepared to understand your options at every step along the way.

Yes, I am a CFP® professional. I’m always a fiduciary and I only work on a fee basis. And yes, I’m still taking on a few great families to be part of my financial planning practice.

If this article has you thinking about your own circumstances, contact my office at rdunn@dunncreekadvisors.com. I am always happy to meet with people who are working on their retirement plans. Dunncreek Advisors does not provide legal or tax advice, nor is this article intended to do so.

NEW LEGAL DISCLAIMER LANGUAGE:

Securities and advisory services offered through Royal Alliance Associates, Inc. (RAA), member FINRA/SIPC.

RAA is separately owned and Dunncreek Advisors LLC,

904 Delaware Avenue, Saint Paul MN 55118, is independent of RAA.